The Crypto Gaming Guilds for Play to Earn Scholarship

Gone are the days when someone spends hours on a video game and derives nothing but entertainment. Now, playing the game can give you more than entertainment; it can become a source of earning money consistently. In addition, it can even become a means of investment to get more profits. Players can now quickly get paid for what they love to do through the play to earn scholarship model.

This game came to the limelight during the lockdown in the Philippines and Indonesia. As a result, many play to earn scholarship became a means of making a living for residents of these countries. However, as much as this opportunity was huge, not all of them could afford the initial deposit to play the game. For example, the Axie Infinity is a game that requires a new player to buy at least three axies before he can play the game at all.

But these axies are not cheap in the marketplace, without which the player cannot form a team to start. Meanwhile, the passion was there for those who saw how much money the earlier players were making from playing Axie Infinity. These large number of game players from developing countries need to find an alternative to investing in this game quickly. So, let us quickly discuss how the crypto gaming guilds came to be.

Origin of the Play to Earn Games Guild

The first gaming guide for the Axie Infinity became necessary as many players who have experience with the type of game could not afford the entry fee. The principal purpose that players derive from creating a play-to-earn gaming guild is to allow game asset owners to lend out the axies that the new players may not have. This system of co-ownership of the digital assets is also called scholarships.

When the players play with this borrowed character, the profits they gain are shared by the game investor and the player. The usual rate involves the scholars taking about 70% of the share, the managers getting 20%, and the guide taking the remaining 10%. After this community guide strategy, other crypto gaming guilds imbibed this scholarship method. As it stands today, the play-to-earn crypto gaming guilds for NFT games are a massive organization with a durable structure.

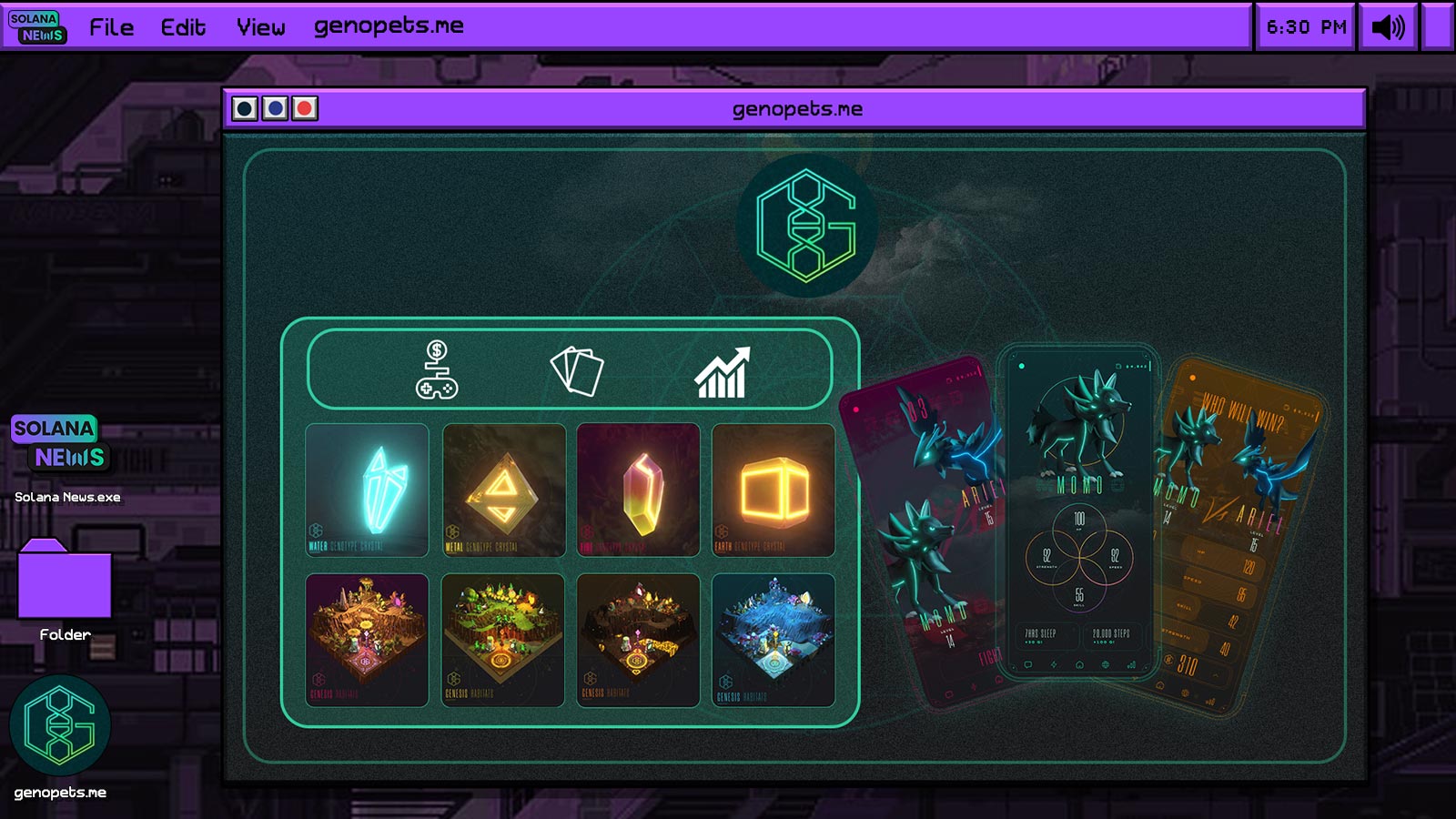

The organization comprises investors, managers, and gamers who are the significant intermediaries in the game environment. Meanwhile, the game players can buy in-game assets such as weapons, characters, monsters, game skins, and land in the form of NFTs. On the other hand, they can also lend them out to different players in their hundreds and thousands. They can keep playing and earning more and more gaming assets from different virtual worlds.

The Difference between Crypto Gaming Guilds and the Traditional Gaming Guilds

When comparing the traditional gaming guilds with the crypto world of gaming guilds, we can be confident that the newer version has several unique features. Traditional gaming guilds have lasted for several decades. Meanwhile, the new NFT gaming system does not deny the game’s competitiveness and has enhanced its popularity. Some competitive gaming guilds include the Cloud9 and FaZe Clan, which represent the best of traditional gaming.

Whereas there is a big difference between the crypto gaming guilds representing play to earn scholarship and traditional games, the players must make a rational decision. Traditional gaming guilds involve the gamers playing the game regularly, with the guilds falling or rising within the game. On the other hand, crypto gaming involves guilds acting as the platform for different natures of support for new gamers. These gamers are also looking to start playing and earning from the games.

There is also a high level of security for the game investors in a play-to-earn gaming guild. The game may lose popularity, and the gaming space becomes challenging to make a profit. In such a case, the gaming guild can then move to another popular game without losing assets. More players can also profit from the organization, and more investors are interested in the crypto VCs. We can easily spot Axie Infinity as we enter the market for better results.

Yield Guide Games (YGG)

The largest guild for play to earn scholarship is the Yield Guild Games (YGG), covering up to $333 million as the market cap. In addition, the market cap was also very high at about $720 million in November 2021. Gabby Dixon, a veteran gamer and a game player on Axie Infinity, developed the YGG in 2020. Meanwhile, YGG as a platform is based on the Decentralized Autonomous Organization (DAO). Also, it adopted the name Guild of Guilds as the first of its kind.

YGG also published an article in the 2021 Year-End Retrospective, claiming that there are over 10,000 Axie Infinity Scholars in over ten countries. These scholars are either in a profit share with the investors or renting the in-game assets in the guild. In the end, the DAO earns about 10% from every paid rental fee. As it stands, YGG has also been able to raise a total of $28.4 million in over 5 rounds of funding at the beginning of this year, 2022.

The top investors on the YGG platform are Animoca Brands and BlockTower Capital. In addition, YGG also developed a native token, known as the $YGG, and it is backed by the ERC-20 token, which they can use for governance. In finance, founders, advisors, and private investors now work with vesting schedules and lock-up periods. Setting up the right policies can also have a massive dump of tokens within the market.

Good Games Guild

The Good Games Guild is a reasonably new crypto guild with well above 300 scholars and more than 117,000 followers on Twitter. The investment arm and game incubator of the Crypto Gaming Guild is the Good Games Guild. Some months ago, the Good Games Guild closed a Seed fundraising round deal worth over $1.7 million. This investment came from Illuvium, OKEx Blockdrean Ventures, Animoca Brands, and others.